Since I’ve been following finance, it seems there’s never been more interest in the federal funds rate and upcoming rate hikes being imposed by Fed Chair Jerome Powell & company. In late 2021, I was sitting in a group fitness class and there happened to be somebody who worked in home mortgages sitting beside me. We were chit chatting about the economy and he mentioned that every time Powell introduced a rate hike, mortgage rates seemed to fall. This didn’t make any sense to me and I questioned him on it. “If the federal funds rate rises, which is the rate banks use to borrow money, how is it that mortgage rates don’t move in lockstep?” He didn’t really have an answer other than telling me that mortgage rates tend to follow the 10 year bond swings more so than federal fund rate changes.

I couldn’t live with that answer, it didn’t make sense to me so I went down the rabbit hole and spent all of 2022 paying close attention to federal funds rate announcements, the 10 year, and mortgage rates.

What did I find?

It turns out that similarly to the stock market, mortgage rates for typical home buyers are forward-thinking. Meaning, the mortgage rates sold to customers have already priced in the expected rate increases (or decreases) of the federal funds right prior to it being announced.

If they are pricing it in, why do rates decrease or remain the same after announcements?

First of all, that’s not always the case but it was mostly in 2022. The reason for the decrease or status quo is there is always a chance of the fed doing something different than what the mortgage market predicts. Let’s say we’re a month out from a fed meeting and they are expected to increase the federal funds rate by 0.5. The market leading up to this event will place odds on the 0.5 increase (perhaps an 80% chance) and give alternative odds to a different increase, let’s say a 20% chance of a 0.75 increase. Once the announcement of the official rate change comes out, the lenders have a guarantee of what the change will be. That removes risk from their business, when the risk of that 0.75 increase is eliminated, mortgage rates drop.

Now on the flip side, if the fed decides to increase the funds rate by 0.75 which the lenders only pegged at a 20% chance, you’re likely to see the 10 year bond and mortgage rates climb significantly. The good news is, these lenders have a lot of very smart people working for them and from my time watching finance, they rarely get it wrong with their expectations.

If you think through this, it seems to make perfect sense. Mortgage offerings almost always include a rate lock period for loans & the mortgage company doesn’t want to be stuck with the difference if they offer a loan a XX.XX% rate and have to borrow at a federal funds rate they did not anticipate. Loaning money is all about risk/reward so whenever some risk can be taken out of the equation, it benefits the lender.

Food for thought – is there a best time to rate lock a mortgage?

As this article began to come together, it brought up an interesting question. Is there a best time to rate lock a mortgage based on the expected fed meeting? The answer seems to be a resounding yes.

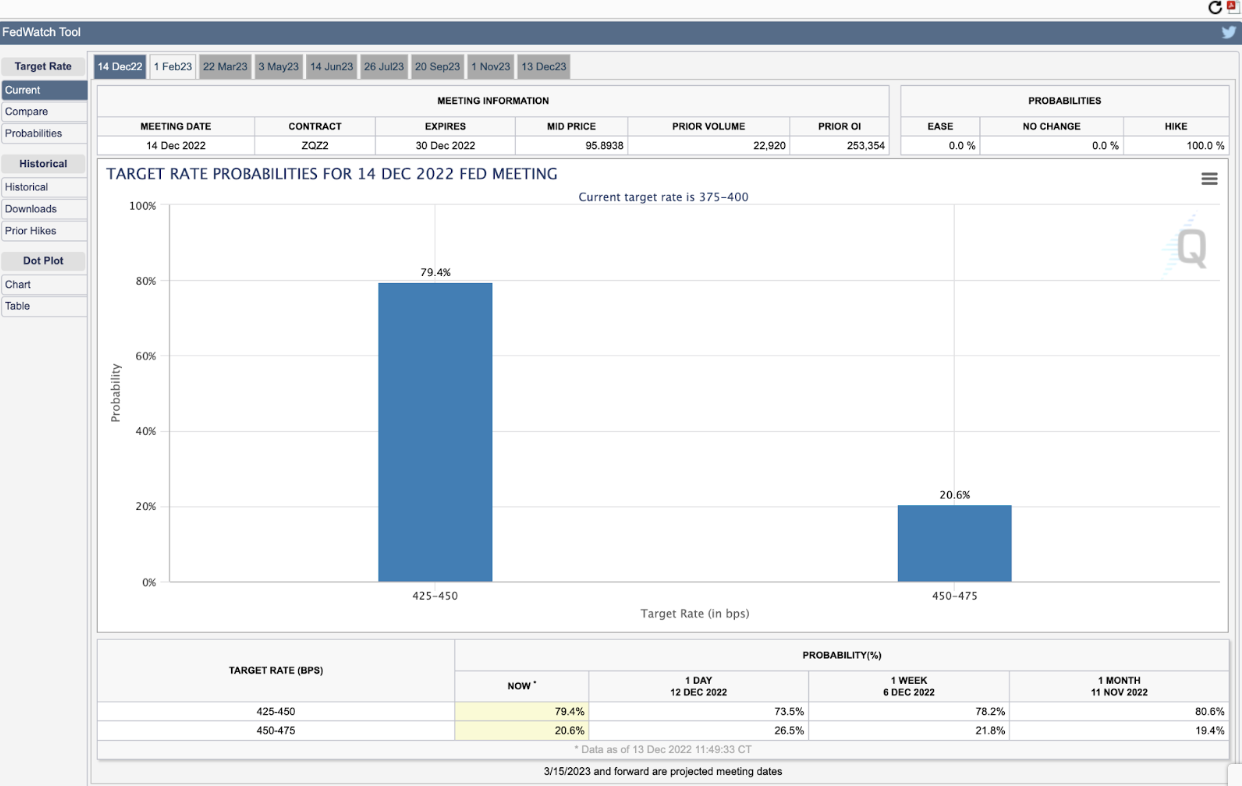

As I write this article, it’s December 13th, 2022 and the Fed is expected to announce their rate hike this week. Below I’ve attached a screenshot of the rate expectations as of today courtesy of the CME Fed Watch Tool.

As you can see, there is a 79.4% chance of a 0.5 point hike and a 20.6% chance of a 0.75 point hike. In this particular situation, I would imagine that it would be best to wait until after the fed announcement when the risk of the 0.75 increase is eliminated as I would expect mortgage rates to fall. On the flip side, if it was reversed and there was a 79.4% chance of a 0.75 and a 20.6% chance of a 0.5 point hike I would anticipate you’re better off rate locking before the announcement. Although, I would add that this may be more of a one-way street. In a situation where they are 80% sure of an increase they have likely already built this into their current rate offering. A lender is ok with their rates being on the higher side of a rate hike but unlikely to risk being on the lower side. Maybe that gives more reason to why mortgage rates don’t seem to go up after announcements?

Do you have any questions, comments or advice to add? Share it in the comments below. Nothing in this article or any articles on my website should be considered financial advice. You should always do your own research and seek professional advice from licensed individuals in their respective fields.

Cabe Nolan

Download this cheat sheet to optimize underperforming posts on your website.